- Huawei can no longer make chips without ARM architecture.

- Suppliers like Lumentum, Neophotonics, and Skyworks have dropped quarterly revenue forecasts following the trade ban.

- 25% tariffs on China will affect Taiwan and the profitability of Apple, Dell and HP sales.

- The UK may ban Huawei next. Europe remains largely indecisive.

- Huawei’s overall operations have taken a hit. It’s selling off the company’s undersea cable business.

A few weeks back, the Trump administration drove an executive order, effectively banning Huawei from dealing with companies in the US. Though surprising, it’s not entirely unexpected either. China vs. US debacle has been happening for years. Even with Huawei, the US government has locked horns on many an occasion. But things suddenly escalated with Huawei coming under the “entity list”. This essentially means that companies under this list cannot deal with any company in the US without the government’s approval.

Then Google cut ties with Huawei, thus rendering Huawei phones outdated to put it politely. Of course, the company has been working on its own OS since 2012, which is said to be called Oak OS globally. Then a few more companies followed suit. Intel, Qualcomm, Broadcom. While this is worrying for the Chinese tech giant, the situation looked somewhat salvageable.

The company claims to have stockpiled enough Qualcomm chips for the next 3 months. In the meantime, Huawei would ideally find alternate options for sourcing its parts. Then ARM waved Huawei goodbye. Now the situation has taken a turn for the worse. This series of events shows how fragile our tech ecosystem is.

Losing ARM

Losing ARM might actually be a bigger problem for Huawei than losing Google. ARM, which is a UK-based company, is responsible for the CPUs inside all smartphones. Without the very hardware that makes the phones function, Huawei has nowhere else to turn to. Sure, the company could probably use another phone manufacturer’s processor. But these are also ARM-based. Chances are, ARM would take legal action.

There are 2 ways of interacting with ARM. The first is to license a processor design created by ARM itself. The second is the architecture license. This is where the licensee designs the chip based on ARM’s intellectual property. Chip designers like Qualcomm use this architecture license.

You might think, so why can’t Huawei make their own? That’s just the problem. There are only a handful of companies with the expertise and resources to create a CPU from scratch. A processor that doesn’t follow the ARM architecture is not something that could be built in a matter of months. We’re talking about a new CPU architecture. This would literally take years.

But the bigger question on everyone’s mind is, can Huawei make do without its US suppliers? Probably. Then again this is getting more and more difficult to pull off for the Chinese company. What’s more, the US government’s actions against Huawei, and by extension China, is sending ripple effects on a global scale.

Sourcing for suppliers: Screens, cameras, and storage are on the safe side

If you take screens, the US company Corning’s Gorilla Glass is on almost every smartphone in the market, including Huawei. Given the possibility of losing access to Gorilla Glass, Huawei could potentially switch to AGC Asahi Glass in Japan as an alternative. Their cameras and RAM suppliers, on the other hand, look to be on the safe side. Cameras found on Huawei phones come from Sunny Opticals, which is a Chinese brand. The RAM has seen a switch in suppliers from US-based Micron found on the P20 Pro, to South Korean SK Hynix on the P30 Pro.

On a related note, the company’s name was earlier removed from the SD Association’s list of members. But later, Huawei was reinstated. Speaking of storage, most of Huawei’s storage chips are supplied by Micron. Now, Huawei may look at implementing its proprietary Nano memory cards for its future phones. High-end phones like the Mate 20 Pro already come with Nano memory card slots.

Then there’s Lumentum Holdings, which is an optical components supplier that’s well known for supplying Apple’s Face ID technology. It also deals with Huawei and has dropped its quarterly revenue forecast by 7.4% – 8.2% following the trade ban.

Taiwan: The attack of the tariffs

According to the fourth U.S. list of proposed tariffs, a 25% tariff is to be implemented on electronic imports such as notebook PCs, smartphones, tablets, and television equipment imported from China. Being a hub for the world’s notebook PC production, Taiwan would take a significant hit if these tariffs come into effect. This is because most of them have their factories located in China.

Taiwanese company Quanta Computer is heavily exposed as a result. With a market cap of $6.9 billion, the company is responsible for building notebooks for Apple and HP. Compal Electronics, which makes PCs for Dell and Lenovo is in a similar position.

As per TrendForce, 90% of parts for Apple, Dell, and HP are dependent on Taiwanese companies. If these tariffs come into effect, Taiwan’s notebook assemblers’ expenditure would rise when exporting to the US from their China factories. In turn, companies like Apple and HP would earn less in sales. This would result in one of 2 things. One, the tech companies may absorb these costs and take a dip in their profits. Two, the companies may transfer these costs to the end consumer.

It’s not just computers. Companies like Foxconn and Pegatron assemble phones in China that are exported to the US. Foxconn, in particular, is feeling the heat with Huawei reducing orders for new phones. All of these firms are directly affected by the current US-China trade war. By extension, it affects users of these products like you and me.

One way Taiwanese companies are looking to tackle this is to move production to alternate countries, ones that aren’t affected by the ongoing trade war. Vietnam shows the most potential as of now. But in fact, 47 companies thus far have pledged that they will shift production back to Taiwan. Last year, even Huawei itself announced its plans to move 90% of its smartphone manufacturing to India within the next 2 years. Although the current crisis might have deflated the company’s ambitions.

Worrying for the networking hardware suppliers

The modules that enable 3G and LTE features on Huawei’s phones are currently sourced by Skyworks and Qorvo, both based in the US. Skyworks’ quarterly earnings and revenue forecast showed a drop in numbers. Shares have dropped 12% since Trump signed the executive order. According to Skyworks, 18% of the company’s revenue comes from Huawei. Following suit, Qorvo is no longer shipping parts to Huawei either.

SKYWORKS CEASED ALL SHIPMENTS TO HUAWEI AND ITS AFFILIATES AS OF THE DATE HUAWEI WAS ADDED TO THE ENTITY LIST AND CANNOT CURRENTLY PREDICT IF AND WHEN SHIPMENTS WILL RESUME

SKYWORKS STATEMENT TO THE MEDIA

NeoPhotonics is another company that deals with the Chinese company. Its bio reads, NeoPhotonics is a leading designer and manufacturer of advanced hybrid photonic integrated optoelectronic modules and subsystems for bandwidth-intensive, high-speed communications networks. In simple terms, the company manufactures parts for fast transferring of data over networks.

Following the Huawei news, the company declared a write-down of some of its inventory. NeoPhotonics may actually be among the worst hit out of all US companies due to the Huawei ban. Why? Because 46% of its revenue comes from Huawei.

The WiFi Alliance has cut its ties with Huawei as well. This means that future Huawei equipment with WiFi capabilities will not be certified by the Alliance. This includes the WiFi modules on smartphones, home routers to network switches. Although, it’s unclear how this will affect Huawei and the larger supply chain in general.

Everybody wants 5G

Speaking of networks, 5G has come under a lot of discussion. Particularly, in the last 2 years. Contrary to popular and often uninformed belief, 5G is not merely a boost in internet speeds. It’s an upgrade for existing 4G infrastructure with an entirely new set of technologies. With 5G, comes a plethora of opportunities.

According to MarketWatch, the 5G market is estimated to be around USD 84.85 billion by the end of 2023. The US, in particular, is looking at grabbing a huge chunk of this pie. This is where Huawei comes into the picture. The tech giant is a key player in the 5G space, with its network and infrastructure facilities playing a leading role in terms of implementing 5G. In fact, the company goes on to say that they are at least 12 – 18 months ahead of any other 5G manufacturer. In the South Asian region in countries like India and Sri Lanka, Huawei is already running 5G trials in collaboration with local telecom operators. By February 2018, Huawei had signed up around 25 MoUs with global telecom operators for testing 5G.

Then there are countries like Malaysia, which are prioritizing building 5G networks. The country’s Prime Minister Mahathir Mohamad went on to praise Huawei, stating Malaysia will use Huawei “as much as possible”.

Additionally, Russia has signed a deal with Huawei to develop the 5G network in the country. The deal was signed with Huawei and Russia’s MTS. According to MTS, the deal will enable “the development of 5G technologies and the pilot launch of fifth-generation networks in 2019-2020.”

On the European frontier…

Back in April, Theresa May declared that Huawei would continue to be allowed to supply 5G equipment. But will not be part of the UK’s core 5G infrastructure. The decision to continue dealing with Huawei comes from advice given by the UK Intelligence agencies who stated that any risk that the company’s tech could be used for Chinese government surveillance could be dealt with.

But with May stepping down, there is a growing sentiment that the next Prime Minister would reverse May’s decision. A final decision on the government’s policy on Huawei is yet to be announced. This essentially puts the UK’s telecom providers’ plans with 5G on an uncertain path. Although the BT Group has been reportedly removing Huawei from its core structure for some time now.

The rest of Europe has largely remained indecisive about the way forward with regard to how the region deals with Huawei. It’s largely to do with the fact that Huawei is already too involved with the current network infrastructure. But that’s not to say the situation hasn’t affected Europe. German company Infineon Technologies AG, STMicroelectronics NV, and Austrian-based AMS AG shares took a hit following the US trade ban on Huawei. France’s telecom operators have already dumped Huawei some time back. Instead, the country is working with Ericsson and Nokia.

The US Secretary of State Michael Pompeo during his recent visit to Germany remarked that the US may have to change their behavior with regards to intelligence sharing with its NATO allies if countries were to continue dealing with Huawei. Of course, these threats have been made before. But with everything that’s happening, combined with increasing pressure from the US, is turning Europe into a potential landmine for Huawei.

It’s almost impossible to remove Huawei from the equation

Despite the Trump administration’s best efforts, it’s almost impossible to keep Huawei out of the game. Why? 5G. Seeing the potential of what 5G can offer to an economy it’s no secret that governments around the world are looking to deploy 5G as soon as possible. Part of this process requires upgrading existing 4G networks, essentially attaching 5G components to legacy hardware. Much of this legacy hardware comes from Huawei.

By Q3 2018, the Wall Street Journal reported that Huawei controlled 28% of the global telecommunications equipment market. Nokia and Ericsson were behind holding 17% and 13.4% of the market share respectively. Even in different regions, Huawei was still in the lead. Much of this is likely attributed to the fact that Huawei’s equipment is relatively cheaper and more advanced than its competitors.

The tech giant is also investing a lot of dough into Research and Development. In 2017, Huawei spent over USD 13 billion on R&D. At present, the company owns 1,529 standard essential 5G patents. So regardless of whether a country or a company chooses to block Huawei, there is no stopping royalties being paid to Huawei to license some of its 5G technology.

Even with the current situation with the US government and Huawei, existing networks cannot be easily replaced. The cost of replacement is high enough that it’s nearly impractical to do so. James Valley Telecommunications, a rural telecom provider in the US, uses entirely Huawei infrastructure for its wireless networks. According to the company, it would cost about USD 50 million to replace all of the Huawei equipment and infrastructure. Additionally, it’s estimated that network replacement of this nature would take about 5 – 10 years. Essentially, even with the current ban in place, Huawei support is still needed, at least to some areas in the US.

This also highlights another issue the US government has given birth to, that is the rural telecom providers. As a result of the trade ban and the security concerns, rural providers that depend on Huawei could be forced to replace their equipment. For carriers like James Valley, this isn’t really practical, to say the least. US’s Rural Wireless Association claims this affects at least 25% of its members around the country.

How China might fight back. It’s not rare minerals

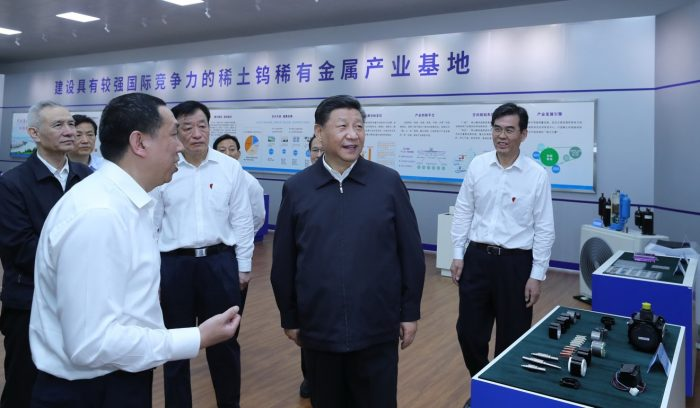

China currently holds ownership of about 35% of the global rare minerals resources. Out of this, a near 80% of the rare minerals imported to the US come from China. Following President Xi’s recent visit to the rare minerals factories, there is speculation that China may use its position in the market as a means of retaliating against the US. The US strangled Huawei, and China strangles the US in return with rare minerals. Of course, such an action would mean that many industries, including tech, would be jeopardized. This is because many industries in the US, from the military to smart cars, to iPhones depend on these rare earth minerals.

But it’s not just the US that would fall into trouble. A significant amount of the workforce in South Jiangxi province (where rare earth minerals are mined) would fall into trouble. The interdependency of China with the US makes it a hard case for China to hit back as easily as the Trump administration has done against Huawei.

But that hasn’t kept the country quiet though. It looks like the Chinese government is coming after US companies. China announced that it’s currently investigating FedEx over “wrongful deliveries”. This is where 2 packages containing documents were diverted to the US from Japan without authorization. The packages were originally supposed to be shipped to Huawei in China.

Just days after this, China fined Ford Automobile USD 23.6 million for antitrust violations. It may seem unrelated at first glance. But given how China arrested two Canadians on espionage charges following Huawei CFO’s arrest, it would be premature to assume any of this as coincidence. After all, China is now making its own entity list dubbed, “unreliable entities”.

A momentary breath of fresh air

So far the only good news Huawei has received was the temporary license issued by the US Commerce Department. It basically allows Huawei to continue software updates and security patches for the next 3 months.

Also on the ARM front, Huawei is allowed to manufacture existing chipset designs such as the Kirin 710, the Kirin 980, and the Kirin 985 chips as well. So for the moment, they look to be safe.

On more good news, the Huawei Mate 20 Pro has been listed under Google’s Android Q Beta eligible list of devices. We’re not sure exactly what this means. But chances are, this is more likely a result of the temporary 3- month license than anything else.

Trump’s recent statement on the matter has shed light to the end of what seems like an endless dark tunnel for Huawei. But it still raises more questions than answers. The conversation reads as follows,

TRUMP: Huawei is something that’s very dangerous. You look at what they’ve done from a security standpoint, from a military standpoint, it’s very dangerous. So it’s possible that Huawei even would be included in some kind of a trade deal. If we made a deal, I could imagine Huawei being possibly included in some form, some part of a trade deal.

REPORTER: How would that look?

TRUMP: It would look very good for us.

REPORTER: But the Huawei part, how would you design that?

TRUMP: Oh it’s too early to say. We’re just very concerned about Huawei from a security standpoint.

According to Trump, Huawei poses a security threat to the United States. But at the same time, he also indicates that there is a possibility in including Huawei in a trade deal with China. No trade deal could possibly ever constitute a disregard for national security. You simply don’t trade security concerns for a good trade deal.

Speculation is that a new trade deal may be made with China prior to the new tariffs which will go into effect on June 25th. In response, Ren Zhengfei, Huawei CEO, stated that “there’s no need for negotiation. I will ignore Trump, then with whom can he negotiate? If he calls me, I may not answer.”

Throughout this whole ordeal, Microsoft has remained quiet on the matter. The company did pull out Huawei laptops from its site, but that’s pretty much it. Being one of Huawei’s biggest software partners it’s surprising the tech giant hasn’t put out an official statement yet. It’s possible that Microsoft is playing for time until the speculated new trade deal is struck.

All this affects you. It makes your tech more expensive.

Huawei’s smartphone business and networking business has taken a massive hit. The company is now starting to take hits in its other operations as well. The company recently reported that it will be selling off its undersea cable business, Huawei Marine Systems. Reportedly, the recent events have made it difficult for Huawei Marine Systems to win contracts. Thereby, Hengtong Optic-Electric, another Chinese company, will be buying Huawei’s 51% stake in the undersea cable company.

So can Huawei be trusted? It’s a tough question to answer because there are real security concerns. In 2017, the Chinese government passed the “National Intelligence” law. This states that if asked, all Chinese companies and citizens are to assist the government in national intelligence efforts. In a scenario where Huawei supplies 5G facilities to a particular country/region, the Chinese government could potentially exploit the situation. Spyware accusations aside, this fact alone would instill fear among Western governments, particularly the US.

China’s reputation isn’t so good in this front. In November 2016, it was reported that an unnamed Australian defense firm was hacked. The firm was involved in developing the F-35 fighter jet for the US. The hackers suspected to be Chinese stole commercially sensitive data on the F-35. It certainly didn’t help when China’s FC-31 Gyrfalcon fighter jet was seen as a knockoff of the F-35. Furthermore, China’s J-20 fighter jet is also seen to have a resemblance to one of the US’s fighter jets, the F-22. The point is, that Chinese hackers attempting to steal corporate secrets from the US are nothing new.

Huawei’s record isn’t squeaky clean either. A 2014 lawsuit alleged that a Huawei engineer stole information pertaining to a T-Mobile diagnostic robot called “Tappy”. The allegation claimed that while visiting a T-Mobile lab in Bellevue, Washington, the Huawei engineer slipped one of the robot’s fingertips into his laptop bag and left with it. In 2017, the jury sided with T-Mobile, and the case was dropped following the settlement.

Then there are instances like what happened in Pakistan. Here, Huawei had to remove WiFi transmitting cards from Pakistan’s surveillance system following authority concerns over the “potential of misuse.”

So to be fair, allegations against Huawei and China may not be completely unfounded. But then again, there has not been any concrete evidence shown with regard to the global security threats that Huawei seemingly poses. This has made the US agenda a tough sell. Hence, the current trade ban on Huawei. But what’s really worrying is how the entire world is forcefully getting dragged into the US-China trade war.

Whether you’re a Sri Lankan who enjoys an affordable smartphone with high-end features, or a corporation looking to introduce 5G to Russia, everybody is tangled in this mess one way or another. This global supply chain is one complicated system with many moving parts. So if you’re confused about why Trump’s actions affect you when you’re on another continent, don’t be. Blame it on economics.

GIPHY App Key not set. Please check settings